- 14

When you pick up a prescription, you expect to pay a predictable amount. But sometimes, that amount surprises you-$150 for a medication you thought was covered, or worse, your plan doesn’t cover it at all. The reason? Your insurance plan uses a formulary tier system to decide how much you pay. Understanding how Tier 1, Tier 2, Tier 3, and non-formulary drugs work isn’t just helpful-it’s essential to avoid unexpected bills.

What Is a Formulary, Really?

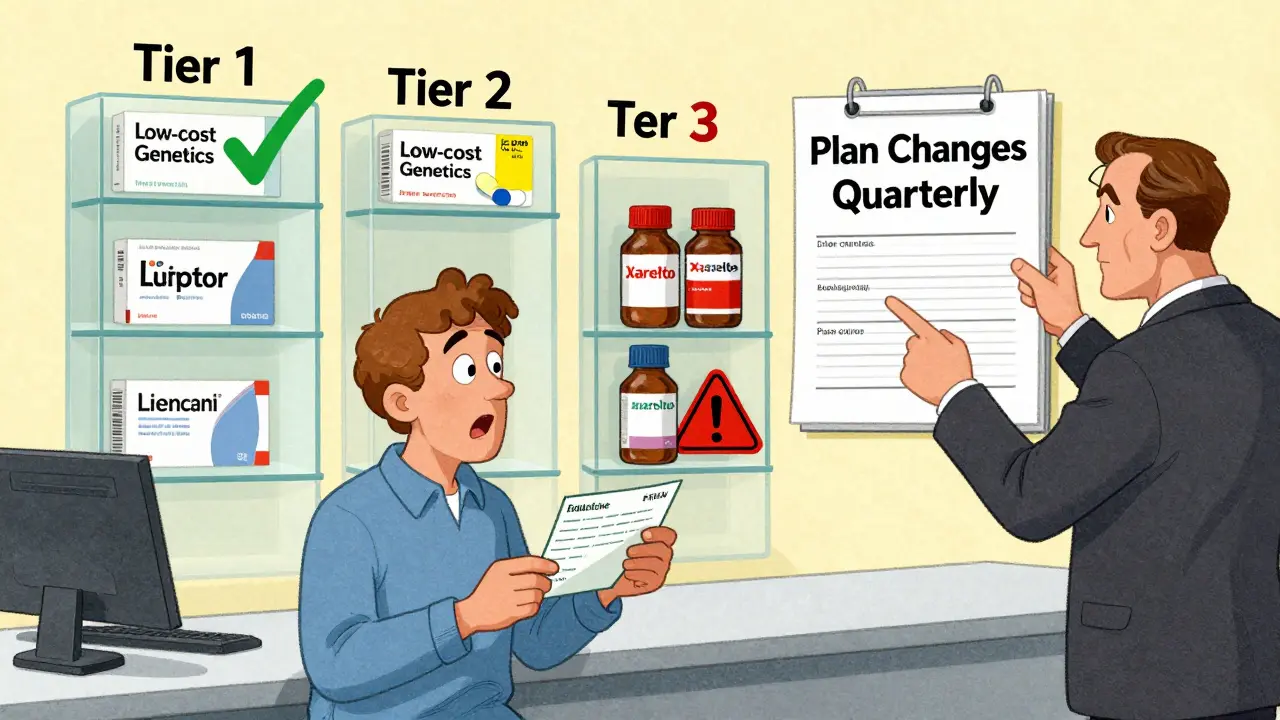

A formulary is just a list of medications your insurance plan covers. But it’s not a simple checklist. It’s a ranked system, divided into tiers, that tells you how much you’ll pay out of pocket. Think of it like a menu at a restaurant: some items are cheap, some are pricey, and some aren’t on the menu at all. The goal? Encourage you to use drugs that are both effective and affordable-while still giving you access to what you need. Formularies are created by your insurer, usually working with a Pharmacy Benefit Manager (PBM) like CVS Caremark, Express Scripts, or OptumRx. These companies negotiate prices with drug makers and decide which drugs go into which tier. The system isn’t random. It’s based on cost, effectiveness, and whether a generic version exists.Tier 1: The Low-Cost Go-To

Tier 1 is where you want to be. This tier is mostly filled with generic drugs that have been around for years. These are the same active ingredients as brand-name drugs but cost a fraction of the price. Examples include metformin for diabetes, lisinopril for high blood pressure, or atorvastatin for cholesterol. In most commercial plans, Tier 1 copays range from $0 to $15 for a 30-day supply. Medicare Part D plans often set Tier 1 copays at $0-$10. You’re not just saving money-you’re using drugs that insurers know work well and have proven safety records. Here’s the catch: not every generic is automatically in Tier 1. If a generic is new or hasn’t been negotiated into a good deal, it might sit higher up. Always check your plan’s formulary before filling a prescription.Tier 2: Preferred Brand-Name Drugs

Tier 2 is for brand-name drugs that your insurer has negotiated a good deal on. These aren’t generics, but they’re still considered cost-effective compared to other brand-name options. Maybe the drug has a strong clinical track record, or the manufacturer offered a big rebate to the PBM. You’ll typically pay $20-$40 for a 30-day supply in a commercial plan. For Medicare Part D, Tier 2 is labeled as "medium copayment" and usually falls in the $25-$50 range. A common example is Lipitor (atorvastatin) before it went generic, or Humira for autoimmune conditions. Even though these are brand-name, they’re still preferred because insurers can get them at a lower price through rebates. That’s why they’re in Tier 2 instead of Tier 3.Tier 3: Non-Preferred Brand-Name Drugs

Tier 3 is where things get expensive. These are brand-name drugs with no generic equivalent-and no strong rebate deal. Insurers don’t push these because they’re costly. But if your doctor prescribes one, you’re stuck paying more. Copays here average $50-$100 for commercial plans. For Medicare Part D, this tier is called "higher copayment" and often runs $60-$120 per prescription. Think of drugs like Xarelto (for blood clots), Eliquis (also for clots), or certain newer diabetes medications like Ozempic before they became more widely available. These drugs are effective, but they cost the insurer a lot. So they put the cost burden on you. Many people don’t realize their medication moved to Tier 3 until they get to the pharmacy counter. Plans can change tiers quarterly. A drug that was in Tier 2 last year might jump to Tier 3 this year. Always check your formulary before refilling.Tier 4 and Tier 5: Specialty Drugs

Not all plans have five tiers, but many do-especially employer-sponsored plans. Tier 4 and Tier 5 are for specialty medications. These are high-cost drugs used for complex conditions: cancer, multiple sclerosis, rheumatoid arthritis, hemophilia, or rare genetic disorders. Instead of a flat copay, these tiers usually use coinsurance. That means you pay a percentage of the drug’s total cost-often 25% to 50%. For a drug that costs $10,000 a month, that’s $2,500 to $5,000 out of pocket. Humana’s 2023 plan documents show Tier 4 at 25-33% coinsurance and Tier 5 at 34-50%. MetLife reports that 78% of employer plans now use four or five tiers, up from just 52% in 2015. The trend is clear: insurers are adding more tiers to separate the most expensive drugs from everything else. These drugs often require prior authorization or step therapy-you have to try cheaper drugs first before your plan will cover the specialty one. It’s frustrating, but it’s standard practice.Non-Formulary: Not Covered at All

Some drugs aren’t on your plan’s formulary at all. That means they’re non-formulary. Your insurance won’t pay for them. You’ll pay 100% of the cost. Why would a drug be excluded? Maybe it’s new and hasn’t been reviewed yet. Maybe there’s a cheaper alternative that works just as well. Or maybe the drug maker didn’t negotiate a rebate. Common non-formulary drugs include certain weight-loss medications, off-label uses, or very new biologics. If your doctor prescribes one, you have options: ask for a formulary exception, switch to a covered drug, or pay out of pocket. Formulary exceptions are requests you or your doctor can submit to your insurer. If you can prove the drug is medically necessary and alternatives won’t work, your plan might approve coverage-sometimes even at a lower tier. The Medicare Rights Center reports that successful appeals can reduce monthly costs from $142 to $45.Why Do Tiers Change? And How Do You Keep Up?

Formularies aren’t set in stone. Plans can update them every quarter. A drug you’ve been taking for years might suddenly move to a higher tier-or get dropped entirely. A 2022 KFF survey found that 43% of commercial plan members had at least one medication moved to a higher tier during the year-often without clear notice. That’s why checking your formulary before each refill is critical. You can find your plan’s formulary online. Look for the "Summary of Benefits and Coverage" (SBC) document. Then dig into the full formulary list-it’s often 100+ pages long. Use tools like Medicare’s Plan Finder or Humana’s Drug Cost Finder to search by drug name. Don’t rely on your pharmacy to tell you the cost. They’ll tell you what your plan says that day-but if the tier changed yesterday, they might not know yet.

What’s New in 2025?

The Inflation Reduction Act of 2022 capped insulin costs at $35 for Medicare beneficiaries, no matter the tier. That’s a big shift. It shows regulators are starting to question whether tiered systems unfairly punish patients with chronic conditions. In 2024, Medicare Part D introduced a new catastrophic coverage phase that lowers out-of-pocket costs for high-tier drugs. By 2025, analysts predict 45% of commercial plans will start using "value-based tiering"-where drugs are ranked not just by price, but by how well they improve health outcomes. Some PBMs are already testing condition-specific formularies. CVS Caremark launched a diabetes-specific tier list in late 2023 that groups drugs by therapeutic class, not just generic vs. brand. It’s a step toward smarter, more patient-focused design.What You Can Do Right Now

- Check your formulary before filling any new prescription.

- Ask your doctor: "Is there a Tier 1 or Tier 2 alternative?"

- If you’re paying too much, ask for a formulary exception.

- Use your insurer’s online cost tools-don’t guess.

- Know the difference between copay and coinsurance. One is a fixed fee; the other is a percentage.

Common Mistakes and How to Avoid Them

- Mistake: Assuming your medication will stay in the same tier. Solution: Review your formulary every January and after any plan change.

- Mistake: Thinking "brand-name" means better. Solution: Generics are just as effective 90% of the time.

- Mistake: Waiting until you get to the pharmacy to find out the cost. Solution: Call your insurer or check online before leaving the doctor’s office.

- Mistake: Giving up on non-formulary drugs. Solution: Your doctor can file an exception request. It takes about 7 days, but it works.

Formulary tiers aren’t perfect. They’re complex, sometimes confusing, and can feel like a game designed to shift costs to you. But they’re here to stay. The key isn’t fighting the system-it’s learning how to navigate it. The more you understand your plan’s structure, the less you’ll pay-and the more control you’ll have over your care.

What does it mean if a drug is non-formulary?

A non-formulary drug is not covered by your insurance plan at all. You’ll pay the full price out of pocket. This usually happens when the drug is new, too expensive, or there’s a cheaper alternative that works just as well. You can ask your doctor to file a formulary exception if the drug is medically necessary.

Why is my generic drug in Tier 2 instead of Tier 1?

Even though it’s a generic, your plan may not have negotiated a good price for it yet, or it’s a newer generic that hasn’t been added to the preferred list. Some generics are placed in Tier 2 if they’re more expensive than other options in the same class. Always check your plan’s formulary to see why.

Can my insurance change my drug’s tier mid-year?

Yes. Insurers can update their formularies up to four times a year-every quarter. They’re not required to notify you in advance. That’s why checking your formulary before refilling is so important. If your drug moves to a higher tier, you can request a formulary exception.

What’s the difference between Tier 3 and Tier 4 drugs?

Tier 3 drugs are non-preferred brand-name medications with high copays-usually $50-$100. Tier 4 drugs are specialty medications, often for serious conditions like cancer or MS. Instead of a copay, you pay a percentage (coinsurance) of the drug’s total cost-often 25-33%. Tier 4 drugs usually require prior authorization.

Are there any drugs that can’t be moved to a lower tier?

If a drug is the only effective treatment for your condition and no alternatives exist, your doctor can file a formulary exception to get it covered at a lower tier. This is common for rare diseases or complex conditions. The approval process takes about a week, and many appeals are successful if medical necessity is clearly documented.

How can I find out what tier my drug is on?

Log in to your insurance plan’s website and look for the "Formulary" or "Drug List" section. You can search by drug name. Medicare beneficiaries can use the Medicare Plan Finder tool. If you can’t find it, call your insurer’s customer service line. Don’t rely on your pharmacy-they might not have the latest update.

Does Medicare Part D have the same tiers as private insurance?

Medicare Part D plans mostly use a four-tier system: Tier 1 (lowest copay for generics), Tier 2 (preferred brands), Tier 3 (non-preferred brands), and a specialty tier for high-cost drugs. Private plans can vary more-some have five tiers, others use coinsurance for Tier 4 and 5. Medicare’s structure is more standardized, but costs can still vary by plan.

Next Steps

- Go to your insurer’s website and search for your top three medications.

- Print or save a copy of your current formulary.

- Ask your pharmacist or doctor to help you identify cheaper alternatives.

- If you’re paying over $100/month for a drug, ask about a formulary exception.

Knowing your formulary tiers isn’t just about saving money-it’s about taking control of your health care. The system is complicated, but you don’t have to be confused by it.

Anu radha

December 16, 2025 AT 21:20So if my insulin is $35 now, why is my blood pressure pill $90? This system feels like a scam.

Joe Bartlett

December 17, 2025 AT 23:35Brits don’t get this mess. We’ve got the NHS. Simple. No tiers. No drama.

Jessica Salgado

December 19, 2025 AT 13:00I had to pay $400 for my migraine med last month. Turns out it moved from Tier 2 to Tier 3. No warning. No email. Just a surprise at the pharmacy. I cried in the parking lot. Not because I’m dramatic-I’m just tired of being treated like a cash machine.

Marie Mee

December 20, 2025 AT 11:46Big Pharma and PBMs are in bed together. This tier system is designed to make you suffer so they can profit. They don’t care if you skip doses. They just want your money. I’ve seen the emails. They’re coming for your thyroid meds next.

Josh Potter

December 20, 2025 AT 19:06Bro I just called my doc and asked for a generic. Got metformin for $5. Life changed. Stop overpaying. You’re not helping anyone by being a hero.

Sachin Bhorde

December 22, 2025 AT 15:23Guys, if you're on a Tier 4 drug, you're basically in the specialty lane. Coinsurance kicks in, and yeah, it's brutal. But if you're on Humira or Enbrel, you're lucky they even cover it. My cousin got denied 3x before they approved it. Prior auth is a nightmare, but it's not the end. Push. Paperwork matters.

Salome Perez

December 23, 2025 AT 23:48The elegance of this system lies not in its fairness, but in its transparency-if you’re willing to dig. Insurers aren’t malicious; they’re algorithmic. Their job is to balance risk and cost, not to comfort you. But that doesn’t absolve them of moral responsibility. We must demand formularies that prioritize health outcomes over profit margins. The Inflation Reduction Act was a start. Let’s not stop there.

Evelyn Vélez Mejía

December 24, 2025 AT 21:25Formularies are the quiet architecture of healthcare inequality. They don’t just separate drugs-they separate lives. The person who can afford to appeal is not the same as the one who must choose between insulin and rent. This isn’t about pharmacy benefits. It’s about who we decide is worth saving.

Victoria Rogers

December 26, 2025 AT 08:52Ugh I hate this tier nonsense. Why do we even have generics if they’re still expensive? My doctor says they’re the same but my insurance says nope pay more. It’s all rigged. I’m switching to crypto for meds next.

Jigar shah

December 27, 2025 AT 10:31My friend in India pays $2 for metformin. Here in the US, I pay $15. Why? Because the system is broken. We have the tech, the science, the resources. But we choose profit over people. It’s not a tier system-it’s a class system.

Steven Lavoie

December 27, 2025 AT 21:29It’s worth noting that formulary tiers are not unique to the U.S. Many European systems use similar structures, but with public oversight and price caps. The difference lies in governance-not in the science of the drugs. Transparency and regulatory accountability are the real solutions.

Patrick A. Ck. Trip

December 29, 2025 AT 10:07I used to think this was just confusing. Now I see it as a survival skill. I check my formulary every January like it’s tax season. I print it. I highlight my meds. I call my insurer before every refill. It takes 10 minutes. It saves me hundreds. This isn’t about being paranoid-it’s about being prepared.

Linda Caldwell

December 30, 2025 AT 13:45Just asked my doc for a Tier 1 alternative and got it. Saved $80 a month. You can do this. Don’t give up. Your health is worth fighting for.

Kent Peterson

December 30, 2025 AT 18:42Ugh, another ‘educational’ post about how to pay more. You know what’s really ‘essential’? Making drugs affordable without making patients play pharmacy roulette. This whole tier system is a corporate loophole dressed up as ‘cost management.’ And now you’re teaching people how to dance to the tune of PBMs? Pathetic.